About APER INDEX

APER INDEX (INDEX) is a research initiative commenced in 2000 by Asia Private Equity Centre Ltd. It is the first and the only reference of returns benchmark in Asian private equity that is publicly-available.

The INDEX is uniquely different as it measures return results via deals, instead of via funds. A host of factors that are characteristic in Asian private equity, have led to the use of such formula in measuring returns -

The INDEX is uniquely different as it measures return results via deals, instead of via funds. A host of factors that are characteristic in Asian private equity, have led to the use of such formula in measuring returns -

- global fund houses

- principal investment arms of financial institutions

- direct investment arms of corporations - multilateral and development financing institutions

- multilateral and development financing institutions

- evergreen funds

As a result, it is impossible to apply the fund returns measurement models commonly used for established markets.

Survey Parameters of APER INDEX

The Tool Evaluate your Portfolio

For Advanced Analysis of Individual Fund Managers’ Performance

The INDEX, with its reservoir of data, can also help users to benchmark performance of individual fund management firms.

Please click here to view the sample and contact us for customised services.

Survey Parameters of APER INDEX

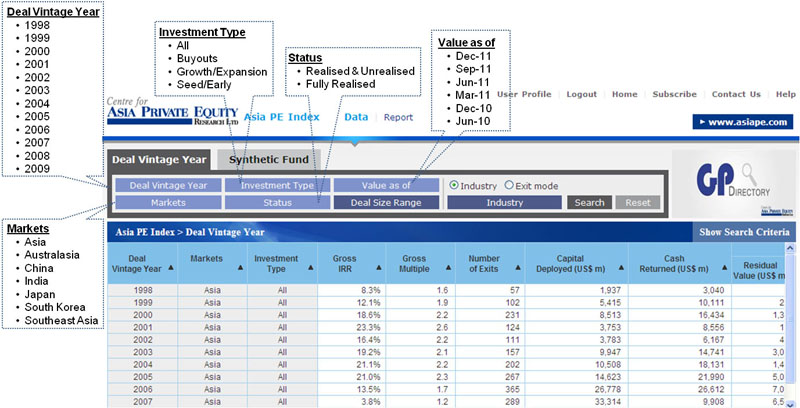

Deal Vintage Year Period - from 1998 to the latest two deal vintage years, inclusive and updated every three months

Valuation Calculation Period - from 1998 to 2 quarters prior to data release date (cut-off date), updated every three months

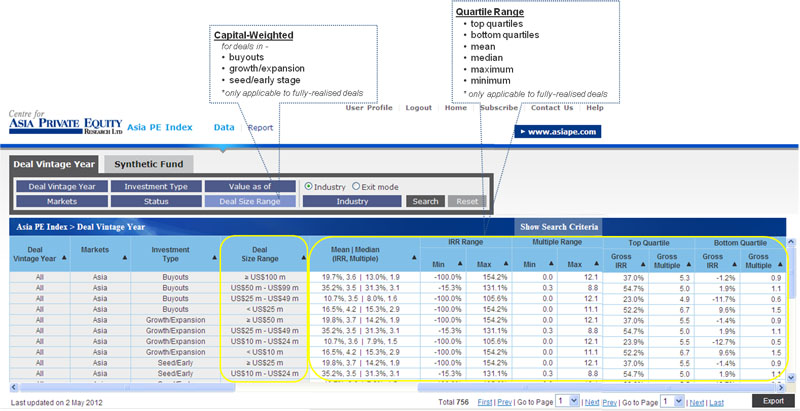

Calculation Methodologies -

Cash returned (including cash dividends) + distributions-in-kind + residual values

Equity capital deployed during period under survey

Residual value + unrealised cost of investment

Residual value + unrealised cost of investment + cash returned

Residual value + unrealised cost of investment

In line with the norm that a fund life’s maximum tenure is ten (10) years, where realisation movements of invested cost is not known for a period of ten (10) years, this is excluded from the calculation

In situations of a partial divestment, the residual value of the unrealised portion is calculated based on either -

All transaction sums in which realisation movements were not known or no divestment process has been initiated as at cut-off date are calculated at cost, including private investment in public equity (PIPE) transactions

All RMB funds are excluded from the calculation

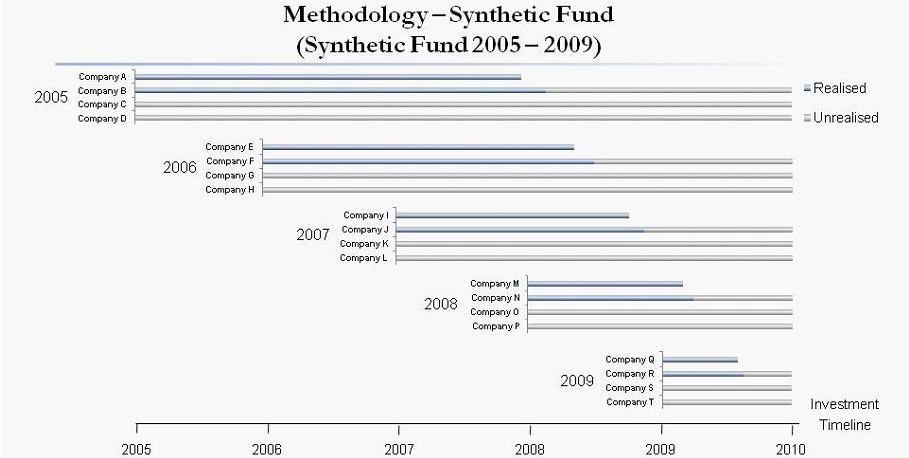

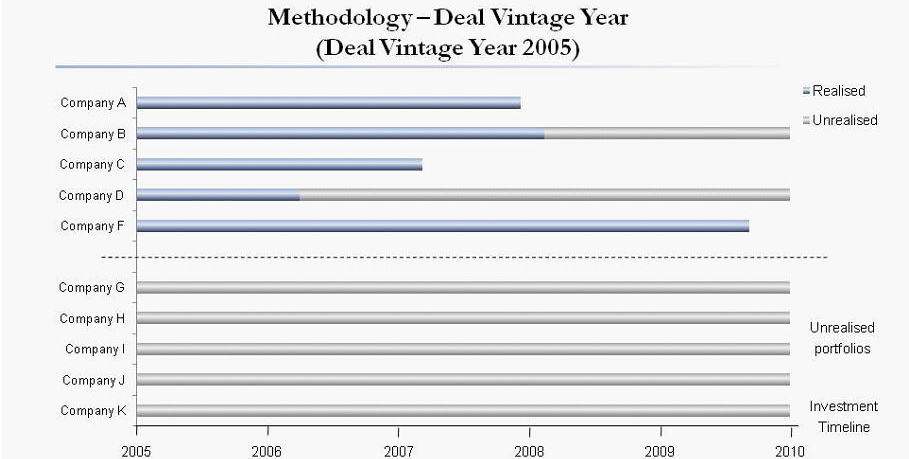

The APER INDEX model is constructed on a deal by deal basis due to the uniquely different private equity landscape across countries in Asia. The INDEX is created by grouping all the deals that were invested in Asia during a prescribed period, aggregating them into a pool as if they were a single fund, and their respective cash flows are used to calculate the overall IRR.

The returns in the INDEX are thus pooled returns that are based on the applicable exits, at the time of providing the data, since the deal vintage year 1998.

Deal Vintage Year data allows users to -

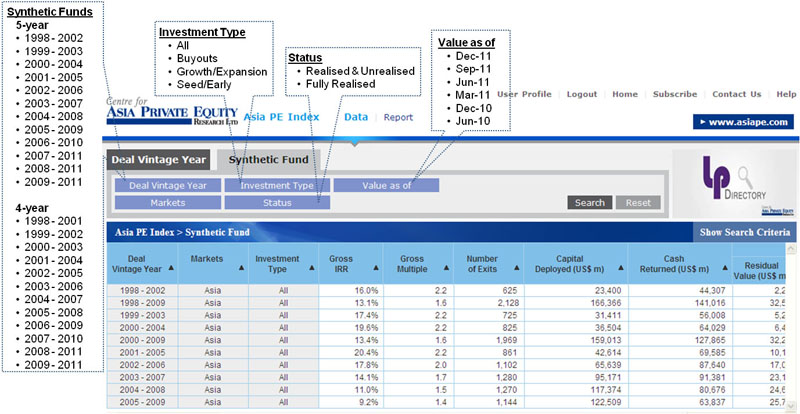

Synthetic Fund groups together returns of deals made in five-year span since 1998. Synthetic Fund data provides users a reference of returns achieved, since 1998